I've been researching Super quite extensively over the last week after seeing that my employer nominated fund, MLC, is charging me exuberant fees for dissapointing returns.

After hours of research i think i'll be going with Australian Super for my superfund

After spending some time narrowing down my options i ended up comparing Australian Super & SunSuper as they are, from my findings, the 2 most appealing & accessible industry funds at this point in time.

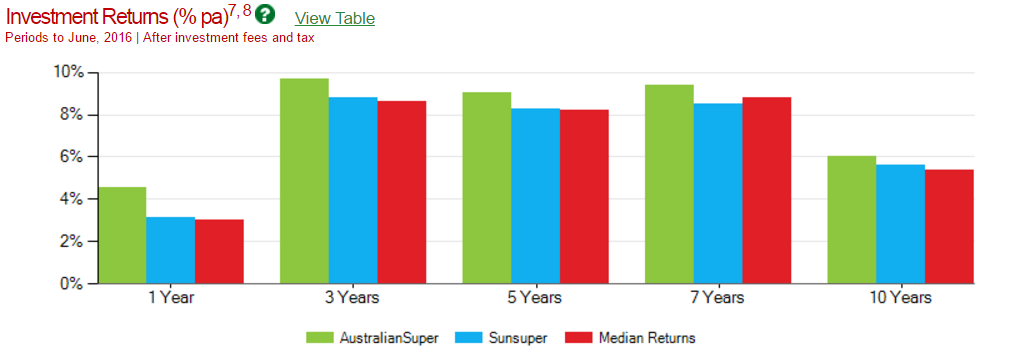

In the realm of management fees SunSuper has a definite benefit over Australian Super. The balanced package of SunSuper boasts an attractively low 0.47%p.a. management fee inclusive of performance fees. On the other hand, the balanced package of AustralianSuper charges 0.53%p.a in addition to a 0.11%p.a. performance fee - bringing the overall fee up to 0.64%p.a. A higher fee seems to spell doom and gloom for Australian Super yet when considering the average returns over the past 10 years the more lucrative fund is made evident.

(Retrieved from ChantWest Supper Apple Check: https://www.chantwest.com.au/)

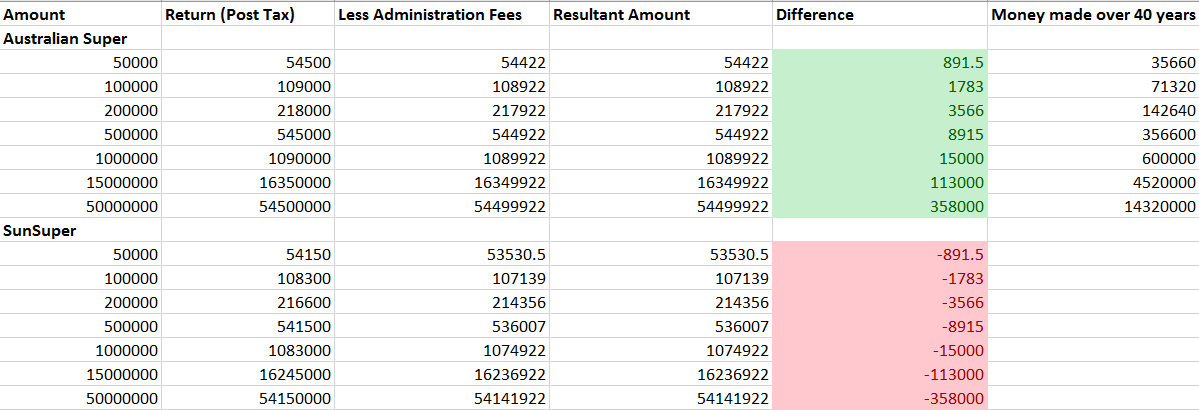

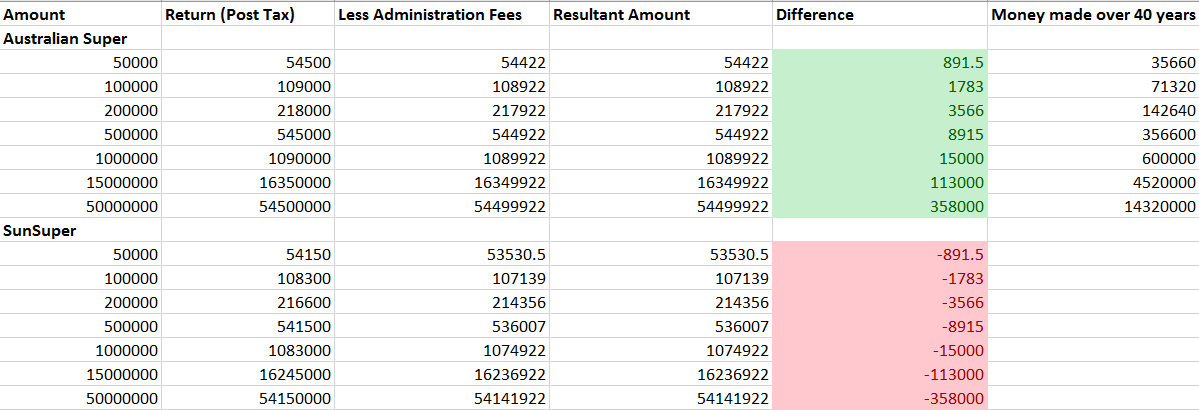

In the area of administration fees Australian Super shines and greatly redeems itself from the aforementioned management & performance fees. Australian Super charges a flat $78 a year ($1.50 a week) regardless of the amount of capital you have under management. SunSuper operates on a model in where administration fees are not fixed and levied at $78 per year + 0.10% of your funds under management up to an $800,000 threshhold. To me, this was very offputing as while you will reap the benefits of lower investment fees with over $800k invested the eventual benefits do not outweigh the losses incurred up unto that point. This is made evident in the below spreadsheet where with $5,000,000 under management you will be putting an extra $35,800 into your pocket when opting with AustralianSuper over the competitor. Given this information it is important to note that the spreadsheet used is simple & according to after tax returns over the past 5 years, only representing fixed returns in a snapshot of time. The information used was only gathered from easily accessible resources including fund websites, product disclosure statements, investment guides & the Chant West Super Apple Check.

I feel that it's worth mentioning that the above 0.10% administration fee can have a big impact on a conservative investor who's main investment vehicles lie in cash

(i.e. bank bills) & fixed interest

(i.e. bonds) which typically hold low risk and low return.

While past performance is not a reliable indicator for future performance Australian Super has had better returns than SunSuper since fund conception and has a more consistent administration fee scheme. This being in addition to a greater range of options for investment and a more aggressive asset allocation that suits my needs

(granted that i will be using the pre-mix 'balanced' option until i gain enough knowledge to be comfortable in trying the DIY methods). There are 1001 other things that constitute a good super fund and i've completely neglected the areas of financial advisory, customer service, taxation

(and the tax breaks granted in a super enviroment), insurance and many others. I've also ignored the existance of anything but pre-mix investment options. This is as i don't know a great deal about investing and have no investing background. Yet this is what i could gather based on 20 hours of time, common sense & what's most important to me.

I can't see myself being a part of a managed fund in the long term and will more than likely move into an SMSF model down the track. Yet this is a complete other area of knowledge that i have to look into.

Also no hate to MLC Masterkey. My investment plan with them is much lower risk than what i will be moving to and it makes excellent use of financial advisers. Yet it's not suitable for my specific situation.