davidbarnes

Trainee Mȯderatȯr

I support a lot of the greens policies though. The mining tax never should have been reduced.

Still pretty amazing to think that a large and violent protest could occur in the UK while the US are paying ~50k/degree and have no kind of govt scheme or subsidization such as HECS.What is going on in the UK though is terrible I. Fees are tripling there and will cost between 9.5K and 15K starting from next year (couple of days time). Now that I think of it, I wonder if they are also tripling the international students fees there (I assume they have these, although are only assuming)?

I support a lot of the greens policies though. The mining tax never should have been reduced.

Unfortunately then, you can only be accurately characterised as a homosexual.I support a lot of the greens policies though.

Err no lol. So long as a gay person is not trying to hit on me (as I am not gay), I have no problem with gay people.Unfortunately then, you can only be accurately characterised as a homosexual.

hahahahahaha, people like you make BOS greatWhat the fuck happened to this forum? That spectularly long post by Abbeyroad presented as a rejoinder to my remarks (which contained an enormous number of assertions regarding the Flynn Effect and the taxonomic validity of the race construct, including a misguided citation of Bamshad, et al) is now gone, and I am incapable of posting what I had prepared as a rebuttal to his post and saved into a notepad file. My rebuttal only contained an attempt to address several specific points and not the broad mass of what he/she had written because that is all I had finished writing before I went to Newcastle. Now the rest of his/her post is gone and I am unable to answer it in full.

This is disappointing.

The Greens however, are a homosexual political party headed by an emanciated homosexual who looks gay and unsurprisingly, is also gay and likes to have sex with men. The ultimate culmination of the Green's policies will be an immigration program that gives preference in admission to AIDS-ridden disabled homosexual Negro women with IQs of 65. The primary supportive demographic of the Greens are emanciated, inner-city effeminate competitive altruists who take part in homosexual parades despite not being gay themselves, and who consider tolerance and the celebration of loser cultures, ugly, single women, people with AIDS and atavistic populations as the highest possible virtue. The only sensible iniative that could possibly involve them would be one that deliberately aimed at abolishing them, preferably through systematic state sanctioned executions.

+1hahahahahaha, people like you make BOS great

This is unnecessary. Even if I wrote something ignorant or wrong...you shouldn't belittle someone for their opinion.

If we look at look at the employment % of the mining industry, its really not a lot.

(it's around 1.3% of jobs in Australia).

Just because we own over 30% of the world's nickle, tantalum etc doesn't mean that we can flood the market with them. We don't have full access to them. What we can mine is determined by technology and the number of mines we have in operation. Owning <40% of the world's nickel and zinc doesn't give us "a pretty significant market position". Australia is not a price setter in the global resource market. China is both the world's largest producer and consumer of resources like zinc, iron etc. That's real market power. We're in no position to dictate the price of minerals. The global resource market is relatively competitive as no single player has absolute market power.Theres a unit of measurement known as the Accessible Economic Demonstrated Resources (AEDR), basically the AEDR measures the amount of stuff in the ground we can actually use under current law in Australia. Laws based on various environmental restrictions, the minerals sitting underneath land owned by the the Dept of Defence or other restrictions based on govt policies.

Using the AEDR we can compare the available mineral deposits in Aus compared to other nations. As shown below.

Basically, Aus owns 15% of all known deposits.

This chart shows that Aus is not only a major supplier but also own significant amounts of minerals, which gives us a pretty significant market position.

wow "our giant 15% of the world's resources"!!! yeah that's enough to assure our global dominance as a resource monopoly! Like dogs, the rest of the world will be begging for our "giant 15% of the world's resources" regardless of how much we raise our prices!!! The demand for Australian minerals is not inelastic, that means as the price increases, demand drops. Minerals from countries like Canada which aren't currently as attractive to the Chinese will suddenly become much more attractive once you raise the price high enough. Don't forget that China has her own mineral reserves, they don't have to buy from us. How arrogant and stupid do you have to be to think that other countries can't survive without our "giant 15% of the world's resources"?Your claims that china will stop purchasing minerals from Aus is pretty unrealistic. It could have some negative impact on foreign investment in the short term, but its stupid to assume that these nations wont come back for our giant 15% of the world's resources. The only people who would be angered by an increased tax would be the overpaid mining CEOs...But I'd love to read your source to China opting out on Aus resources or increasing their prices as a result.

The reason mining companies earn so much is because we're in the middle of a demand-driven resource boom and we're lucky enough to be located relatively close to China and India - the main driving force behind the boom. I love how you just pull that "3x the profit" out of your ass while the graph clearly shows that the service sector earns almost as much. Should we also tax the service sector, the health care sector and the utility sector because they earn more than the industry average? The 12.5% difference in profit between the mining sector and the service sector can be easily accounted for by the resource boom. Why can't companies earn an abnormal profit in times of prosperity? Let's not forget that the only reason they are earning an abnormal profit is due to the government's refusal to accept more Chinese investments in the sector. If the entry barriers were removed or even lowered, Chinese firms will continue to set up shop here until everyone is earning (relatively) normal profit. This would be a win win situation as the Chinese will have a secured access to minerals and the government will have a steady stream of tax revenue. By setting up a high entry barrier the government ensures that mining companies will make an abnormal profit, they then use this as the justification for more taxes. What it really comes down to is opportunistic money grabbing by the state. The government basically gets something for nothing. If you wanted a share of the profit, buy out the companies. Take over new investments. Act like a business instead of a highway bandit.Now if you view the 2008/2009 profit margin for mining compared to other industries (remembering that mining only employs 1.3% of Australian jobs)

The 11.2% of total industries is the average of all the industries in Australia, so the mining industry takes more than 3x the profit of all other industries by pulling parts of Australia out of the ground.

Theres more information based on mining exploitation if you were to look...Something like the Aus Mining EBITDA (earnings before interest,tax,depreciation and amortisation)/Revenue is 43% while that of mining companies around the world is 30%.

More importantly, I really think it's important to acknowledge that an increased tax against the mining industry would equal Funding for long term infrastructure projects, education, future proofing Australia, bigger incentives for Research and development. Equally as important, I think we should try to acknowledge why the over-reaction towards the mining tax has occurred.

O rly? I mean they don't have to buy their machinery or pay their workers, geologists and pilots or anything. No, they do not add value to their product, they just literally pull it out of Australian Soil and claim their product to sell around the world!111!11! No sir, their capital goods are stolen, their workers are slaves and their contractors are all kidnapped!!!1! Those vile imperialistic capitalist running dogs!!1!!Mining companies do not add value to their product, they literally pull it out of Australian Soil and claim their product to sell around the world. Why shouldn't all Australians get some benefit considering those resources are fetching astronomical prices...and why should the mining industry get such tax breaks?

This has nothing to do with "engineered consent". People aren't objecting because the evil media told them to, they do not pull these arguments out of their asses, they are based on economic models developed by economists more intelligent than you. How can we "pretty much see that an increased tax rate on the mining industry would affect none besides the corporate giants who are exploiting the Australian people." when economics tells us otherwise? You are economically illiterate and intellectually stagnant. Quoting Chomsky and making dumb ass assertions won't save you. While you're at it, why don't you talk about how we are brainwashed by mathematicians and philosophers such as Pythagoras and Aristotle to follow reason and logic instead of emotions and irrationality?It's actually pretty interesting to see the control that the media has on the Australian people. We all saw those ridiculous commercials of workers falling over due to the mining tax...however, we can pretty much see that an increased tax rate on the mining industry would affect none besides the corporate giants who are exploiting the Australian people. If anyone has the time, I really recommend reading Noam Chomsky's Manufacturing Consent ...it actually got made into a documentary, but I havent watched it yet...The book itself talks about political control through the media, and I've never read such a book that relates so much today as it did during its publication.

Please excuse spelling and grammar...I'm in a rush.

Need I honestly have to point out that you're not going to be a non-tax paying student forever?As a non-tax paying uni student, I see no disadvantage for me.

also there might be net surplus for the economy as there is more skilled workers

"Idealistically" isn't a word. Don't use it in public, or you'll be picked up on it and then your face will go red like a spanked monkey's arse.Idealistically it would be a great idea to make uni for free but it's just not practical

lol wut. A tax on revenue and a tax on profit is one and the same - in both cases the firm would be getting less than it was before. To use my earlier example, a 10% tax on a revenue of $30 would mean that instead of making a $10 profit, the firm would be making $7, in other words, the cost had gone up from $20 to $23. A 10% tax on profit would have the same effect: instead of getting $10, the firm would only get $9, the cost is now $21. Whether the firm can pass on the increased cost depends on the demand elasticity of its good: if the demand was perfectly elastic, then, of course, the firm can't pass the tax burden onto its customers without affecting sales, if on the other hand, the demand was perfectly inelastic, then ho ho ho. In reality, no goods are perfectly elastic or inelastic, so more often than not, the tax burden is shared by the producers and consumers. Taxation creates distortions, someone will be made worse off as a result. There's no such thing as a neutral tax. Taxation is robbery and you can't argue against that. What it really comes down to is whether such a robbery is justified.So much motherfucking economic illiteracy in this thread. You're all retards.

For starters, a tax upon profits does not increase the price of the good. Assuming they're already profit maximising, they can't pass the tax onto consumers without shooting their net profits in the foot as well.

In that sense, yes it's true. In fact, the same could be said for any two types of tax, no matter how different their form. That's kind of the point of taxation.lol wut. A tax on revenue and a tax on profit is one and the same - in both cases the firm would be getting less than it was before.

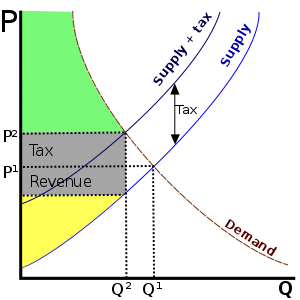

There still remains a distinct difference between tax on revenue and tax on profit. A tax on revenue is exactly the same as a tax upon prices or upon quantity. If revenue(R) = price(P) x quantity(Q) then for a tax on revenue:To use my earlier example, a 10% tax on a revenue of $30 would mean that instead of making a $10 profit, the firm would be making $7, in other words, the cost had gone up from $20 to $23. A 10% tax on profit would have the same effect: instead of getting $10, the firm would only get $9, the cost is now $21. Whether the firm can pass on the increased cost depends on the demand elasticity of its good: if the demand was perfectly elastic, then, of course, the firm can't pass the tax burden onto its customers without affecting sales, if on the other hand, the demand was perfectly inelastic, then ho ho ho. In reality, no goods are perfectly elastic or inelastic, so more often than not, the tax burden is shared by the producers and consumers.

Agreed. Not sure whether this was directed at me though. If it was, then you've misinterpreted what I orginally said.Taxation creates distortions, someone will be made worse off as a result. There's no such thing as a neutral tax. Taxation is robbery and you can't argue against that. What it really comes down to is whether such a robbery is justified.